generated from zeon-studio/hugoplate

-

Notifications

You must be signed in to change notification settings - Fork 3

Commit

This commit does not belong to any branch on this repository, and may belong to a fork outside of the repository.

- Loading branch information

1 parent

4bafdbe

commit 2fb4f0f

Showing

1 changed file

with

114 additions

and

0 deletions.

There are no files selected for viewing

This file contains bidirectional Unicode text that may be interpreted or compiled differently than what appears below. To review, open the file in an editor that reveals hidden Unicode characters.

Learn more about bidirectional Unicode characters

| Original file line number | Diff line number | Diff line change |

|---|---|---|

| @@ -0,0 +1,114 @@ | ||

| --- | ||

| title: "The DeFi Collective - March 2024 Report" | ||

| meta_title: "" | ||

| description: "Monthly report for the treasury-related activities of the Collective in March, a record-breaking month for the association." | ||

| date: 2024-04-15T05:00:00Z | ||

| image: "/images/tdc-march-2024-report-cover.png" | ||

| categories: ["Monthly Report"] | ||

| author: "luude" | ||

| tags: ["TDC Monthly Report", "Liquidity Management", "Liquidity-driving Tokens", "Collective"] | ||

| draft: false | ||

| --- | ||

|

|

||

| Welcome to the Collective's March treasury report, and it’s a good one! March saw the Collective’s liquidity-driving assets reach eye-popping heights; liquid positions rise strongly with the market, and total revenues over 2x those of February. All while expenses have been our highest since inception. With all this being said, let's dive in to see what the best month in the Collective's short history looks like. | ||

|

|

||

| As always, for more information on the Collective activities, where the revenues come from, and the accounting logic, please refer to [the Reporting Policy](https://deficollective.org/reporting-policy/). | ||

|

|

||

| This report is also [available in PDF format](https://github.com/deficollective/deficollective.github.io/blob/main/assets/images/tdc-march-2024-report/tdc-march-2024-report.pdf). | ||

|

|

||

|

|

||

| ## Treasury Report | ||

|

|

||

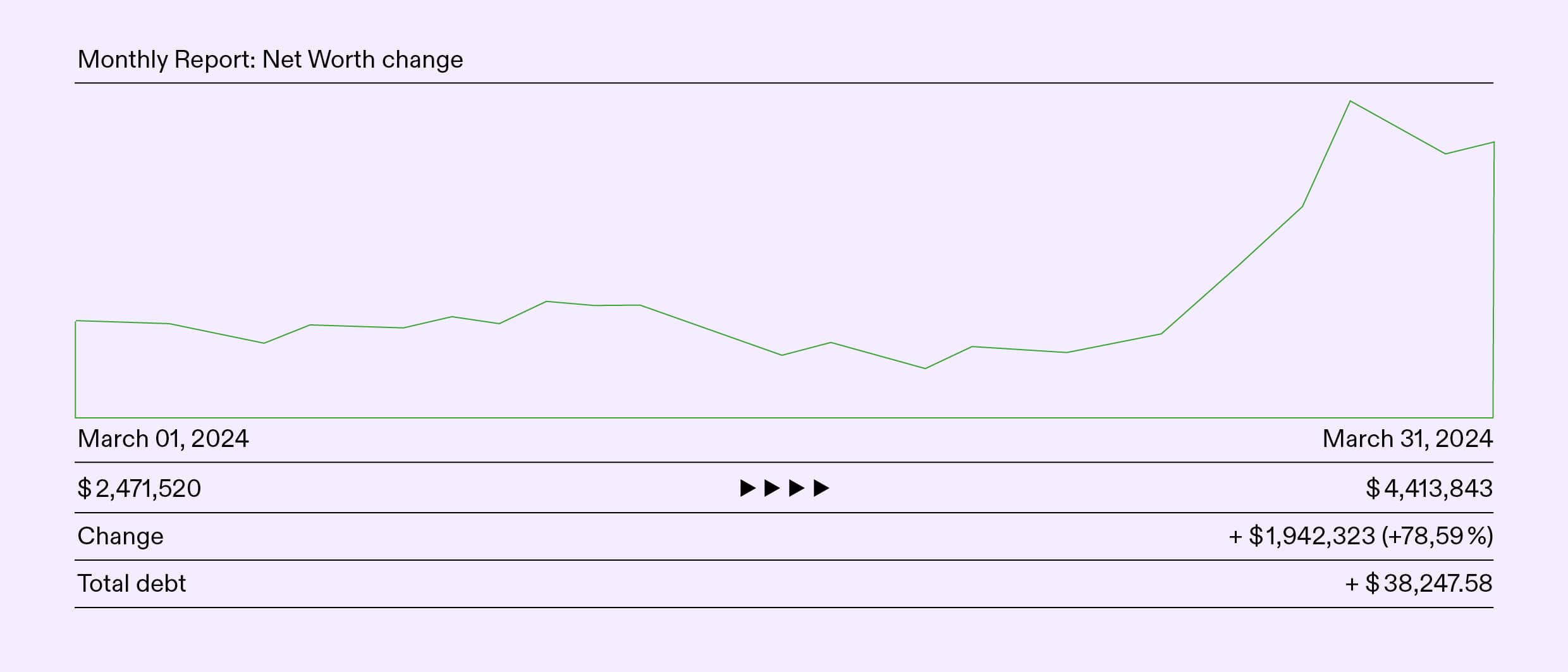

| **The face value of assets controlled by the Collective** (excluding grants) **grew by 78.59%** in March, jumping from $2,471,520 on the 1st of March to **$4,413,843** by the 31st of March. This extraordinary growth was again driven by the outsized performance of the Collective's main liquidity-driven positions veVELO and veAERO, with Ramses veRAM joining the party with a 4x increase over the month. | ||

|

|

||

|

|

||

|  | ||

|

|

||

|

|

||

| No new chains were launched in March, but the Collective did start its initial support for a newly launched CDP protocol on Optimism Lets Get Hai. The collective began its on- and off-chain support by seeding an HAI/LUSD pool in Velodrome and beginning the discussion on Hai’s Commonwealth forum to improve the HAI & KITE liquidity. More details on this will be outlined later in the Impact Report section below. | ||

|

|

||

|

|

||

| ## Expenses Report | ||

|

|

||

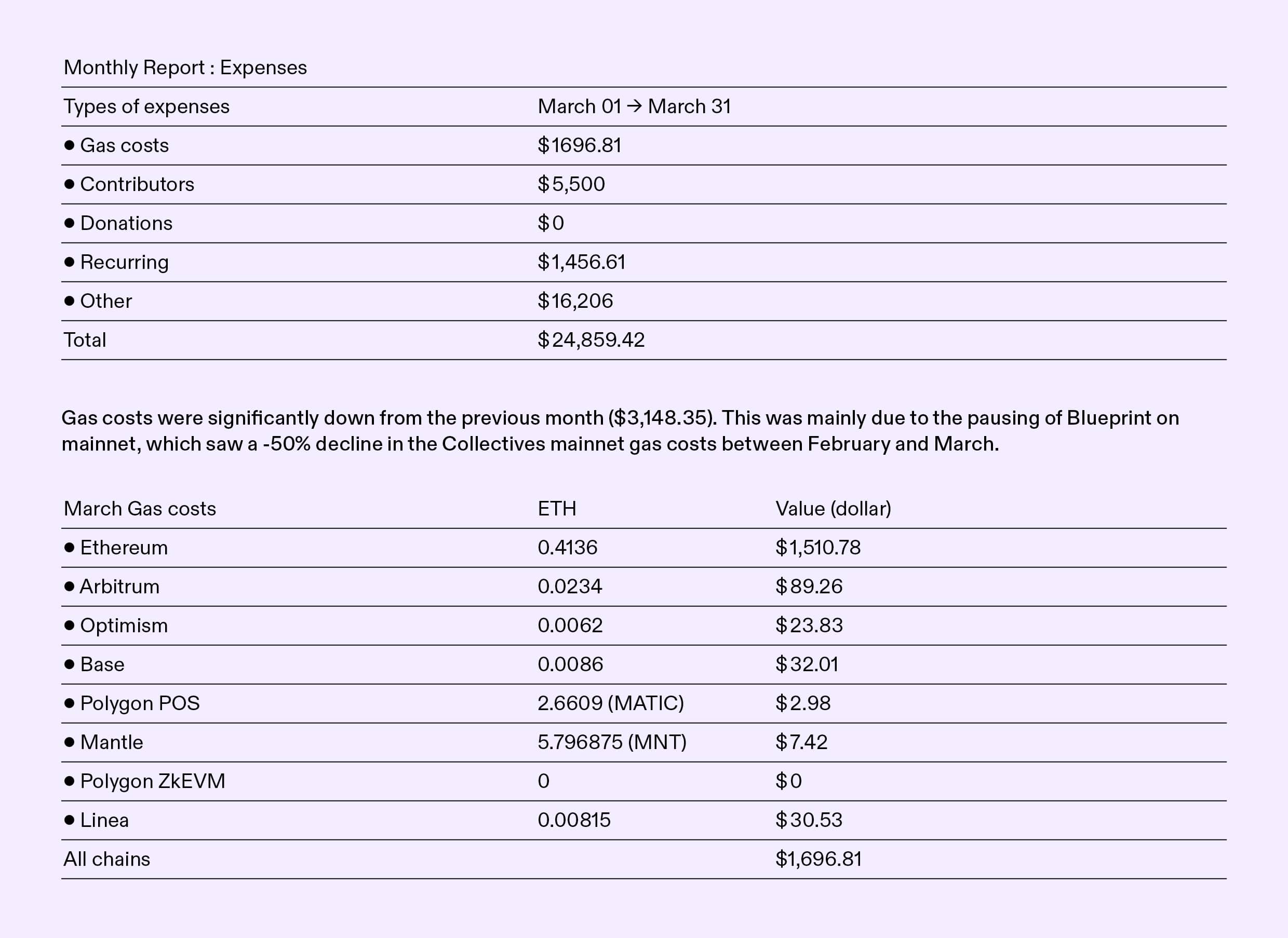

| March also saw the Collective’s expenses reach new heights, which, unlike the revenues and position values, we do not see sustaining. This was primarily due to an invoice for numerous design tasks, including the Collective’s visual identity and website design, due in March. Recurring expenses and contributor costs remained steady from February. | ||

|

|

||

| Gas costs were significantly down from the previous month ($3,148.35). This was mainly due to the pausing of Blueprint on mainnet, which saw a -50% decline in the Collectives mainnet gas costs between February and March. | ||

|

|

||

|  | ||

|

|

||

|

|

||

| ## Revenues Report | ||

|

|

||

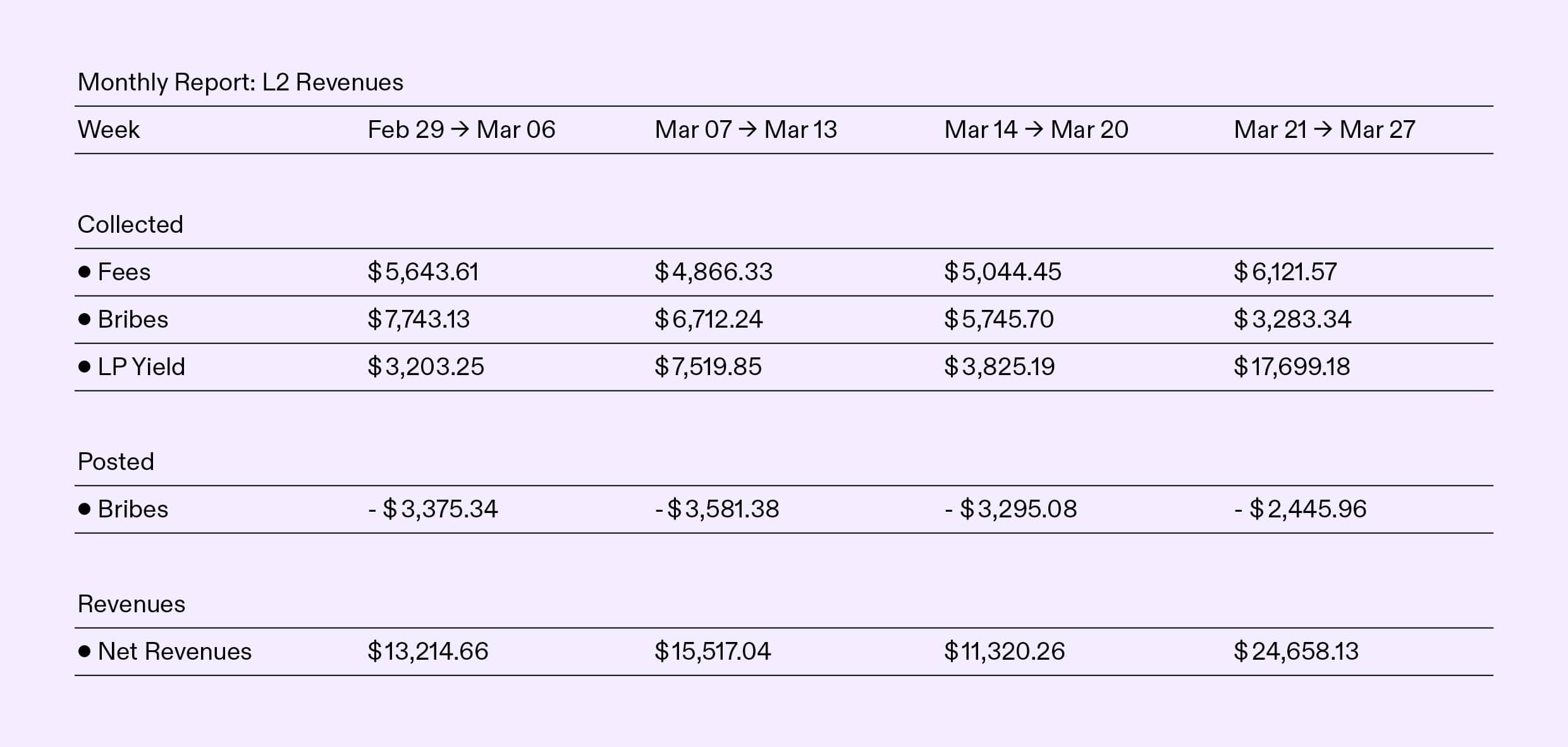

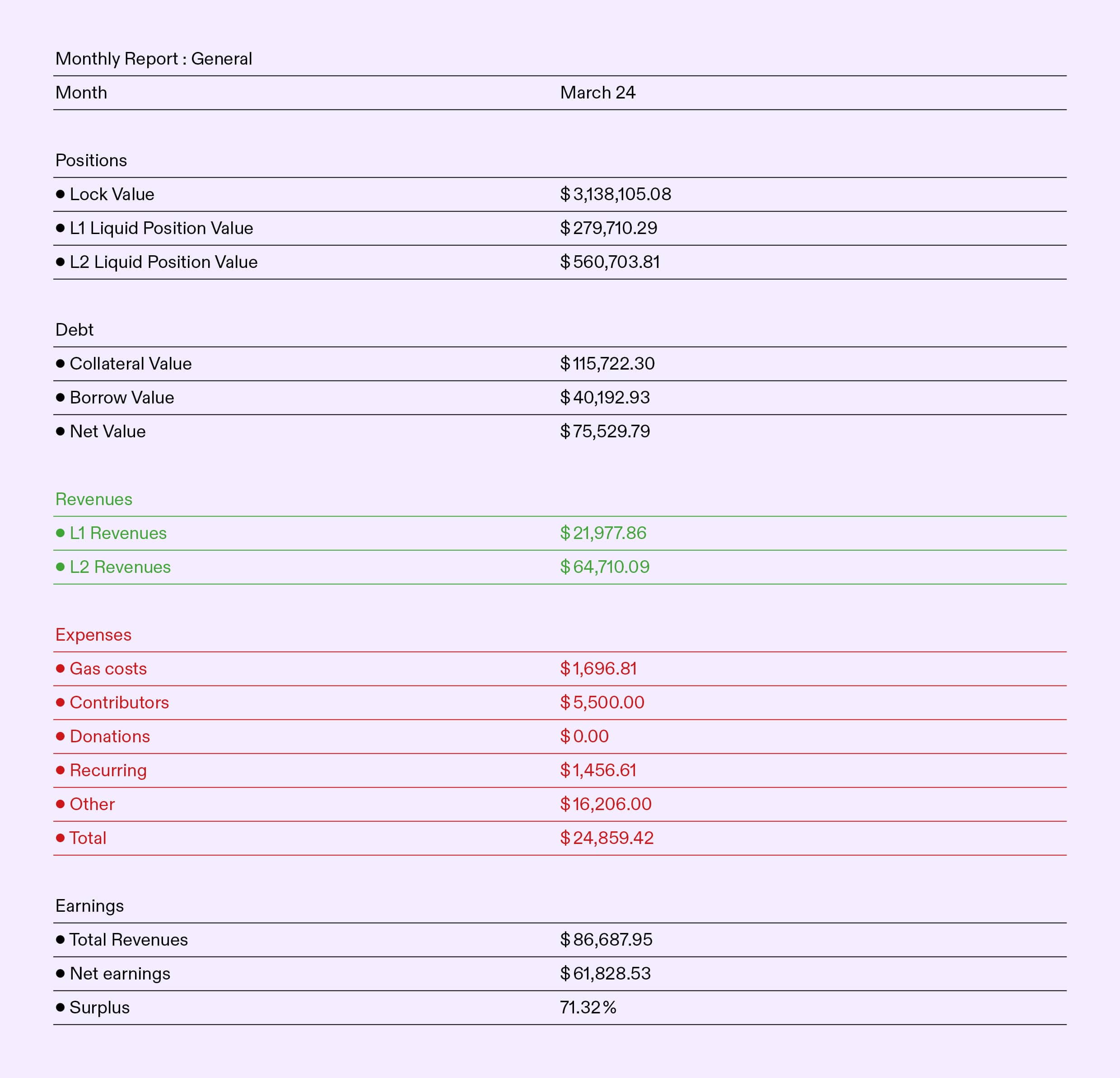

| **Revenues are up 130.91% compared to the previous month, settling at $86,687.95**. Even with the increased expenses outlined above, this big revenue jump enabled the Collective to have its most profitable month yet, netting $61,828.53 that can be recycled back into support for DeFi's most resilient protocols. | ||

|

|

||

| The Collective's presence on various Layer 2 remains the main source of revenues, with Optimism, Arbitrum and Base as the top three layers both in terms of assets deployed and revenues generated. | ||

|

|

||

|  | ||

|

|

||

| As ants are sustainable creatures, we have also started tracking the revenues/expenses surplus, which has consistently exceeded 70% for most of the Collectives' history apart from one month. This is an important metric to track, as it will allow us to grow sustainably as we onboard new contributors. | ||

|

|

||

|

|

||

|  | ||

|

|

||

|

|

||

| ## Impact Report | ||

|

|

||

|

|

||

| ### Mainnet | ||

|

|

||

| The Collective maintained their large bribes towards the DYAD/LUSD and bLUSD/LUSD pools on Blueprint over the first two weeks of March; however, due to poor performance of the BLUE token and low fees generated by these pools bribe support was stopped. This was quickly followed by the Blueprint team pausing BLUE emissions for the time being as they optimize some features, such as vote carryover, to suit the mainnet gas conditions better. | ||

|

|

||

| Due to the ceasing of BLUE emissions and an overall pullback in the market, the ants decided to seize the opportunity and buy the ETH dip to prepare for the upcoming support for ETH-denominated LPs coming in April and May. This saw bLUSD being redeemed and the Collective adding 15E to the treasury. | ||

|

|

||

| The DYAD/LUSD position was swapped to a DYAD/USDC position and added to Uniswap, which allows the Collective to earn KEROSENE emissions from DYAD. | ||

|

|

||

|

|

||

| ### Arbitrum | ||

|

|

||

| Ramses returned to its previous glory days for the ants during the month of March as it outperformed all our other liquidity-driving positions in terms of veRAM price appreciation, bribes, and fees collected. The ants positioned an opportunistic LQTY/LUSD position and threw the full force of the colony behind it, with some large bribes and voting power directed towards this position. The stars aligned and RAM went vertical, allowing the Collective to derive its largest weekly revenue ever recorded from a single LP position, at $12,700. | ||

|

|

||

| As Ramses are trying to maintain the momentum around their exchange, we will continue to bribe substantially to support our large LUSD/LQTY position, build a larger RAM position, and begin support for new pools soon. | ||

|

|

||

|

|

||

| ### Optimism | ||

|

|

||

| March saw the ants getting busy offchain. We submitted a proposal to the Lets Get Hai Commonwealth forum to improve the HAI and KITE liquidity on Op mainnet. The proposal was sent to vote and passed with a 79% vote towards yes. The Collective will now support HAI and KITE liquidity on Velodrome, with work to begin in April. | ||

|

|

||

| Regarding the current liquidity strategies on Velodrome, the strategy changed slightly, with a small cleanup of some residual LP positions, such as the LUSD/GRAI pool being moved to a HAI/LUSD position as we prepare for the upcoming liquidity partnership. This consolidation of LP positions puts all the supported pools in good standing to benefit from the Collectives' almost 6M veVELO voting power. | ||

|

|

||

|

|

||

| ### Base | ||

|

|

||

| Much like February, March saw AERO reaching new heights, with the face value of the Collectives veAERO position increasing over 6x! The continued locking of veAERO has also supplemented the Collective's yields of LP positions, which saw our veAERO balance increase by 12% MoM. | ||

|

|

||

| Again, just like February, the main focus of our operations on Aerodrome the LUSD/USDC pool doubled its TVL to over $1.5M, while still maintaining attractive returns for depositors. | ||

|

|

||

|

|

||

| ### Polygon-PoS | ||

|

|

||

| On Retro, the strategy remains consistent with the previous months, with the veRETRO voting power allocated to support Bluechip pools like wMATIC/wETH, wBTC/wETH, or wMATIC/USDC. | ||

|

|

||

|

|

||

| ### Mantle | ||

|

|

||

| The liquidity operations on Mantle remain largely unchanged, with the ants continuing to support a LUSD/USDC pool on both Cleopatra and Stratum, with a bi-weekly bribe structure taking place. We will continue to monitor the success of our strategies there with the hopes of growing LUSD liquidity on Mantle. | ||

|

|

||

|

|

||

| ### Linea | ||

|

|

||

| Our operations on Linea are very similar to the ones on Mantle. We support an LUSD/USDC position with some gentle bribes and voting on Nile as we watch the ecosystem's development closely. The pool has started to see some encouraging growth in March, approaching $50k TVL. | ||

|

|

||

|  | ||

|

|

||

|

|

||

| ### Parting Words | ||

|

|

||

| March was the most successful month in the Collectives' history, with long-term targets being reached in terms of revenues generated and treasury balance. We aim to continue this momentum into April, which will see the ants ramp up support for Let's Get Hai on Optimism and some yet-to-be-announced partners on Arbitrum. | ||

|

|

||

| The Collective also published the much-anticipated Treasury Management Policy, which will give readers further context behind these monthly reports and how the treasury management team operates. We have also been hard at work on the Mission-Critical Protocol Guidelines, which are very close to being published. | ||

|

|

||

| As mentioned in February's report, the Collective has been working to onboard two more contributors covering content strategy and community management. Some strong candidates have applied, and we are working through the selection process as we speak, so expect some announcements of new additions to the contributor team soon. | ||

|

|

||

| April is already shaping up to be another fantastic month, so without spoiling it in this report, I will leave it here. | ||

|

|

||

| — Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice, Abmis and myself. |